Two years ago, I wrote about my lifelong passion (some would say obsession) for spare change.

This dates back to counting the spare change and “egg money” in my grandmother’s chipped gravy boat in the 70’s and continues on today.

Today, this is the spare change stash in my office:

But here in the 21st century, especially during a pandemic, I don’t have a lot of cash transactions, and therefore not a lot of spare change.

Enter the micro investing app Acorns which invests your digital spare change.

Two years ago, I signed up for Acorns and linked my checking account. The checking account is my “funding source”.

Then I linked my credit card. You can link more than one card including debit cards.

For every transaction on the linked card, Acorns “rounds up”.

For example, yesterday I bought a Kindle e-book (one of my guilty pleasures) and used my credit card. The total was $8.79. The round-up will be 21 cents.

When the round-up total gets to $5.00 it is withdrawn from the funding source account and invested in the low-cost ETF portfolio of my choice at Acorns.

If I have an even dollar transaction, for example, $40.00, the Acorns default is to round up a whole dollar. This didn’t make any sense to me — a dollar is not spare change! But this amount is adjustable. I changed the whole dollar transactions to round up 10 cents.

The fee is $1/month. This is deducted from my checking account. It does not reduce the balance in my Acorns portfolio.

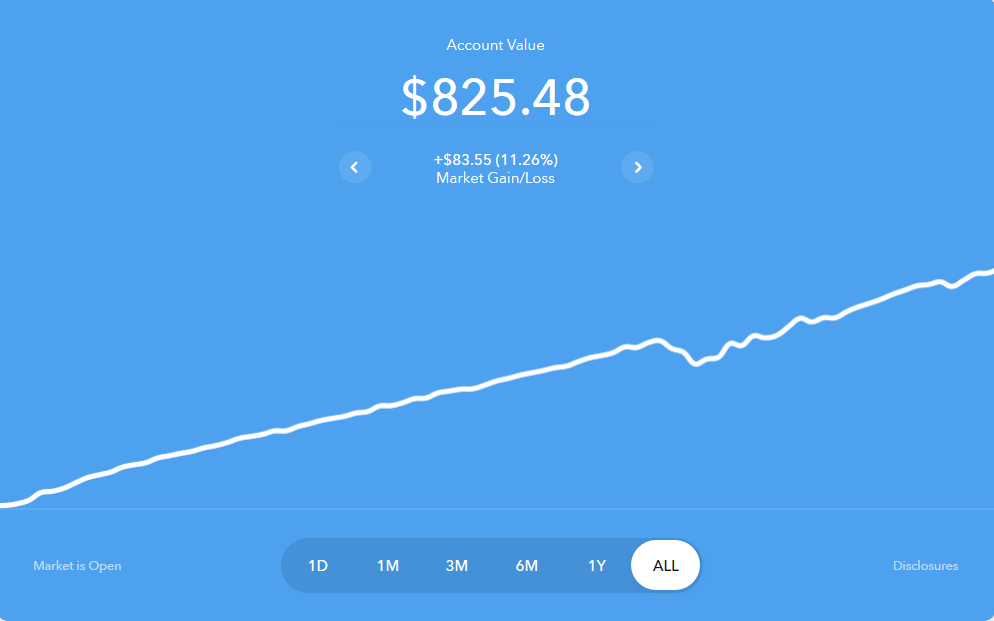

Two years later, this is my Acorns account value history:

My account value is $825.48

$83.55 (11.26%) of that balance is market gain since I began the account 2 years ago. This gain includes reinvested dividends and appreciation of the shares.

*Note this data does not take into account the $1/month fee.

You can see the balance took a dip earlier this year when markets dropped at the beginning of the pandemic. It’s never pleasant to see a decrease in your balance, but the upside is buying shares at bargain prices.

There are five ETF portfolios to choose from ranging from “Conservative” to “Aggressive”.

I chose Moderate which is 60% stocks and 40% bonds.

The portfolio is well diversified across several asset classes. The stock ETFs hold 11,000+ different stocks!

Acorns rebalances regularly.

I’m pretty tickled with this.

I have $825.48! Beyond the initial set up and adjustment of the whole dollar round ups, I’ve done absolutely nothing. I rarely look at it. Everything is automatic.

Automaticity is one of the keys to successful saving and investing.

Now obviously I’m not going to get wealthy doing this. But I love the idea of automatically saving and investing amounts so small that I don’t even notice. Acorns says the average user invests over $30 a month through Round-ups. My average is about this.

Of course there will be another huge market downturn and my balance will drop. (I don’t know when this will happen and neither does anyone else!) Then I will be buying stocks on sale again.

I don’t have a plan for this money yet. Maybe I will wait until it reaches a certain dollar amount and cash it in to do something really “splurgy”. This will incur some capital gains tax.

For now I’m content to keep rounding up and auto investing.

It’s a glorious age we live in when a mere $5 gets you a diversified stake in the wealth creating power of the global capital markets! This certainly was not the case in the 70’s when I was counting egg money on the shag carpet at my grandmother’s house.

*I do not have any affiliation with Acorns.