It is that time of year when Social Security/Medicare recipients receive letters outlining their 2024 benefits. About 7% of Americans will see an ‘IRMAA’ surcharge on their Medicare premiums. Read on to learn more about IRMAA.

What is IRMAA? IRMAA stands for Income-Related Monthly Adjustment Amount. It is an additional fee levied on top of the basic Medicare Part B and D premiums for those above certain annual income thresholds.

How is IRMAA determined? Your IRMAA amount depends on your tax filing status and income.

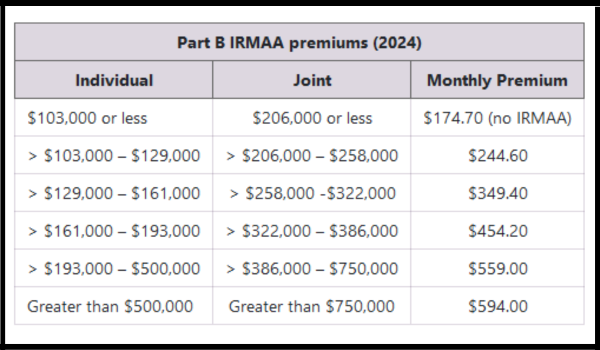

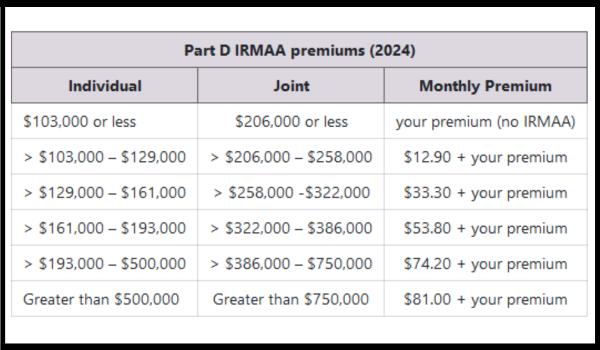

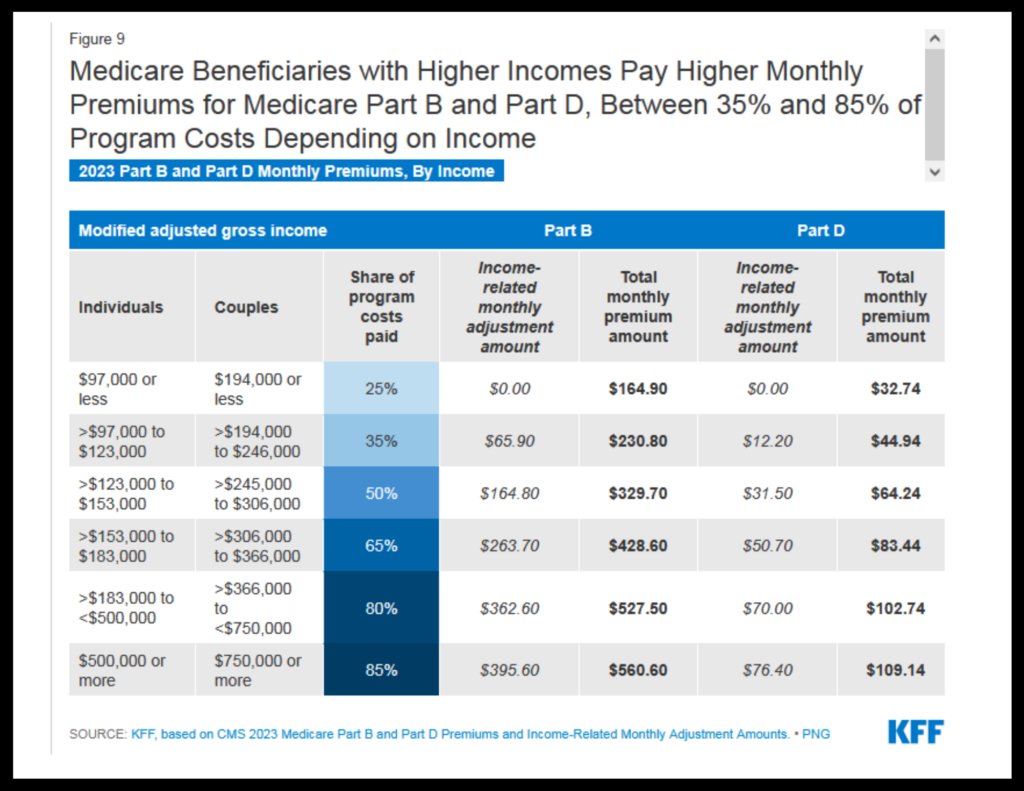

These charts from Medicareresources.org show the IRMAA amounts at various income levels (called tiers) for Medicare Part B and D premiums in 2024.

Medicare uses your Modified Adjusted Gross Income (MAGI) from two years prior for the current year – the 2024 premiums are determined based on 2022 data.

What is my Modified Adjusted Gross Income for IRMAA purposes?

Your Modified Adjusted Gross Income (MAGI) is your Adjusted Gross Income (AGI) + tax-exempt interest.

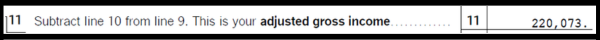

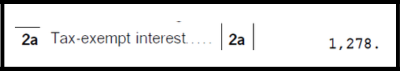

To find these numbers, look at your 2022 Form 1040-SR or 1040.

Adjusted Gross Income is Line 11. Tax-exempt interest is Line 2a.

Example: Jim and Mary are married and file taxes jointly. In 2022 they had Adjusted Gross Income of $220,073.

They had tax-exempt interest of $1,278.

Jim and Mary’s Modified Adjusted Gross Income is the sum of these = $221,351.

Looking at the above charts, we see their Medicare Part B premiums for 2024 will be $244.60/month each. This is $70 above the base premium of $174.60.

Their Medicare Part D premiums for 2024 will be their Part D plan premium (this varies depending on the plan chosen) plus an additional $12.90/month each.

And now for the editorializing….

Clients are often concerned about their IRMAA surcharges, particularly when it is a big jump due to an unusually high income year.

For example, a few years ago clients of mine normally in the lowest tier for Medicare premiums sold their rental property. They owned it for a long time and their capital gain was over $250,000. This combined with their other usual income put them in the next to highest IRMAA tier. They paid these higher premiums just one year. The next year their premiums reverted back to their usual base tier amount.

Certainly it’s understandable to be concerned about increased expenses.

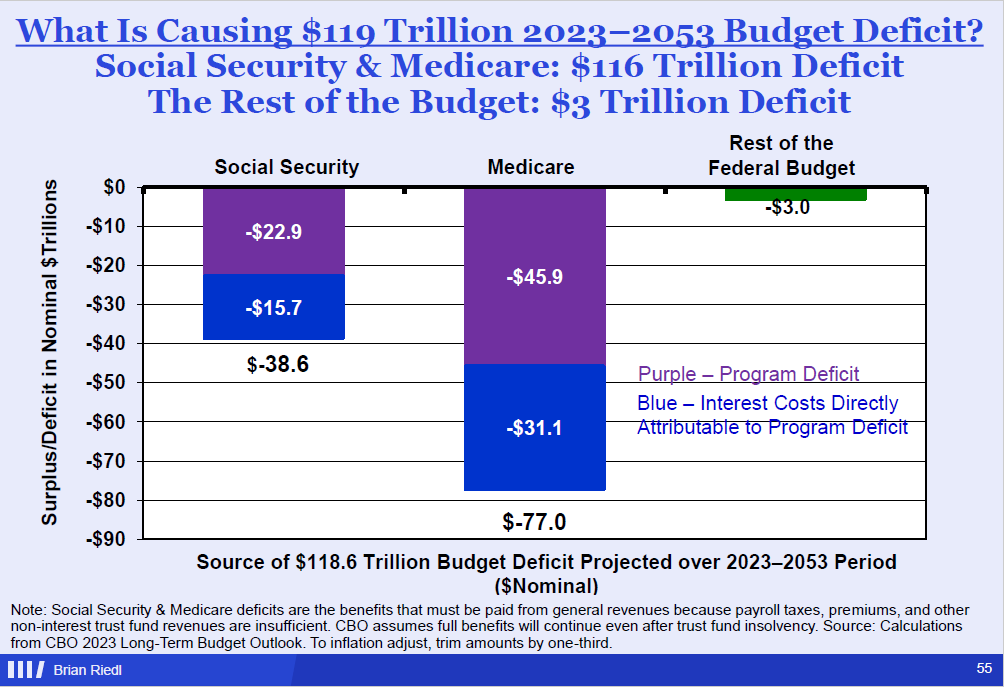

But here’s the thing– the Medicare program is expensive. Really expensive. For the next 30 years Medicare and Social Security are projected to run a $116 trillion deficit. These two programs are by far the biggest drivers of future projected deficits.

This chart is one of many fascinating and sobering charts in Brian Riedl’s “Spending, Taxes, and Deficits: A book of Charts”, published by the Manhattan Institute.

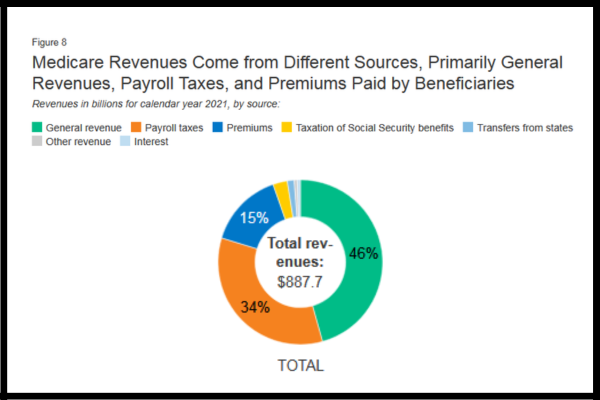

Medicare deficits occur because the benefits paid are greater than the premiums and payroll taxes collected.

According to KFF, an independent health policy research non-profit, Medicare premiums (paid by Medicare recipients) and Medicare payroll taxes (paid by working people and their employers) cover only about half of the cost of the Medicare program.

Which brings us back to IRMAA. Even the premiums paid at highest IRMAA Tier (for income greater than $500K/year for singles and$750K/year for marrieds) do not cover actual Medicare program costs. (From KFF)

More evidence that Medicare premiums do not cover the actual cost: the price of a Medicare equivalent policy in the private marketplace.

I asked Chris Smith, an independent health insurance broker how much an unsubsidized insurance policy with Medicare-like coverage would cost for a 64 year old. Answer: $1400/month.

Medicare and Social Security are on clear paths to insolvency.

Every American should be concerned about this. Action must be taken. I don’t claim to know the solution, however it’s hard to imagine any solution that does not include higher Medicare taxes and/or premiums.

The bottom line: The implosion of Medicare would be terrible; today’s IRMAA surcharges aren’t so terrible.