In my last blog article, I reviewed Federal income tax liability.

Today we move to Social Security tax.

Almost all workers, whether they work for themselves or someone else, pay Social Security taxes.

How much do you pay?

Let’s begin with taxpayers who work for someone else.

Employees pay Social Security tax of 6.2% on their Social Security wages. This is automatically withheld from pay.

Their employers also pay 6.2% of pay for a total of 12.4%.

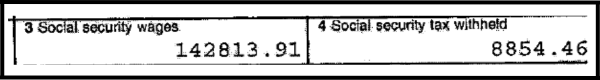

You can see this on your W-2 form, Boxes 3 and 4:

This client had Social Security wages (Box 3) of $142,813.91

This number multiplied by 6.2% = Social security tax withheld (Box 4) of $8,854.46

Her employer also paid $8,854.46.

You can also check your pay stub for Social Security tax withheld.

This client’s pay stub lists Social Security taxes as “Fed OASDI/EE”. OASDI = Old-Age, Survivors, and Disability Insurance EE = Employee

Some pay stubs more plainly label it “SocSec” or even better “Social Security Employee Tax”. You also see it abbreviated “FICA” = Federal Insurance Contributions Act. (Medicare taxes are also FICA taxes and listed separately)

The 6.2% Social Security tax applies to all wages up to the Social Security wage limit. In 2023 this wage limit was $160,200.

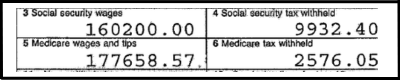

Let’s look at another client:

This client had Medicare wages (total wages excluding some non-taxable items) (Box 5) of $177,658.57.

Her Social security wage (Box 3) was the wage limit of $160,200.

This number multiplied by 6.2% = Social Security tax withheld (Box 4) of $9,932.40

Her employer also paid $9,932.40.

Toward the end of 2023 when this client reached the Social Security wage limit of $160,200 her deductions for Social Security tax stopped and her take-home pay went up.

In January 2024 her Social Security tax deductions began again. In 2024 the Social Security wage limit is $168,600. It goes up each year based on inflation.

You can check your Social Security statement to make sure your wages were recorded properly. Your statement lists your earnings record. Your 2023 “Earnings Taxed for Social Security” should equal Box 3 of your 2023 W-2 form.

What if you work for yourself?** Self-employed taxpayers pay both the employee share and the employer share of Social Security taxes. (6.2% + 6.2% = 12.4% up to the Social Security wage limit). The amount due is calculated on the taxpayer’s federal tax return.

Let’s look at another client.

She is a self-employed consultant operating as a sole proprietor. She files a Schedule C to report her business income and expenses.

**For the sake of simplicity we will not review self-employed taxpayers who are taxed as S-Corporations or Partnerships.

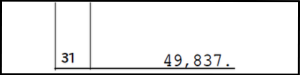

Line 31 of the Schedule C is Net profit:

Her net profit was $49,837.

Net profit is multiplied by 0.9235 and then multiplied by 12.4% to calculate total Social security tax.

You can see this calculation on Schedule SE of the tax return.

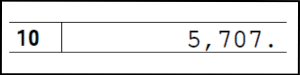

$49,837 * 0.9235 * 12.4% = $5,707.

Schedule SE Line 10:

Self-employed sole proprietors do not have taxes withheld from paychecks. They typically pay both their income taxes and Social Security/Medicare taxes by making quarterly estimated tax payments throughout the year.

Lastly, if you are a public employee you may not pay in to Social Security depending on your state.

In Massachusetts, public employees do not pay in to Social Security.

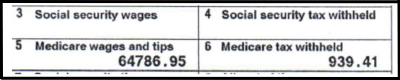

The W-2 form of a client who is a public school teacher in MA:

She had Box 5 wages of $64,786.95.

Box 3 and 4 are blank – she did not pay into Social Security and neither did her employer.

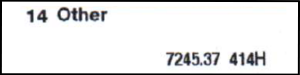

Instead she has mandatory pension contributions of 11% deducted from her paycheck. These are seen in Box 14 of her W-2.

I would be remiss if I did not point out that Social Security is running a deficit. This is a serious problem that Americans of all ages should be concerned about. You can learn more from Brian Riedl’s terrific article “Ten Myths Sabotaging Social Security Reform”

The article begins with this sobering assessment: “The Social Security system’s persistent and growing deficits are scheduled to bring trust fund insolvency within nine years, which would force a 23 percent benefit cut. Yet most lawmakers refuse to discuss solvency reforms because voters … have fallen victim to common myths about Social Security’s finances.”