Five years ago, I wrote about my lifelong passion (some would say obsession) for spare change.

This dates back to counting the spare change and “egg money” in my grandmother’s chipped gravy boat in the 70’s.

Today, this is the spare change stash in my office:

But here in the 21st century, I don’t have too many cash transactions, and therefore not a lot of physical spare change.

Enter the micro investing app Acorns* which invests your digital spare change.

Five years ago, I signed up for Acorns and linked my checking account. The checking account is my “funding source”.

Then I linked my credit card. You can link more than one card including debit cards.

For every transaction on the linked card, Acorns “rounds up”.

For example, yesterday my husband used the linked credit card to buy cat food at Petco. The total was $22.95. The round-up will be 5 cents.

When the round-up total gets to $5.00, it is withdrawn from the funding source account and invested in a low-cost ETF (Exchange Traded Fund) portfolio of my choice at Acorns.

If I have an even dollar transaction, for example $40.00, the Acorns default is to round up a whole dollar. This didn’t make any sense to me — a dollar is not spare change! But this amount is adjustable. I changed the whole dollar transactions to round up just 10 cents.

The fee is $3/month. This is deducted from my checking account. It does not reduce the balance in my Acorns portfolio.

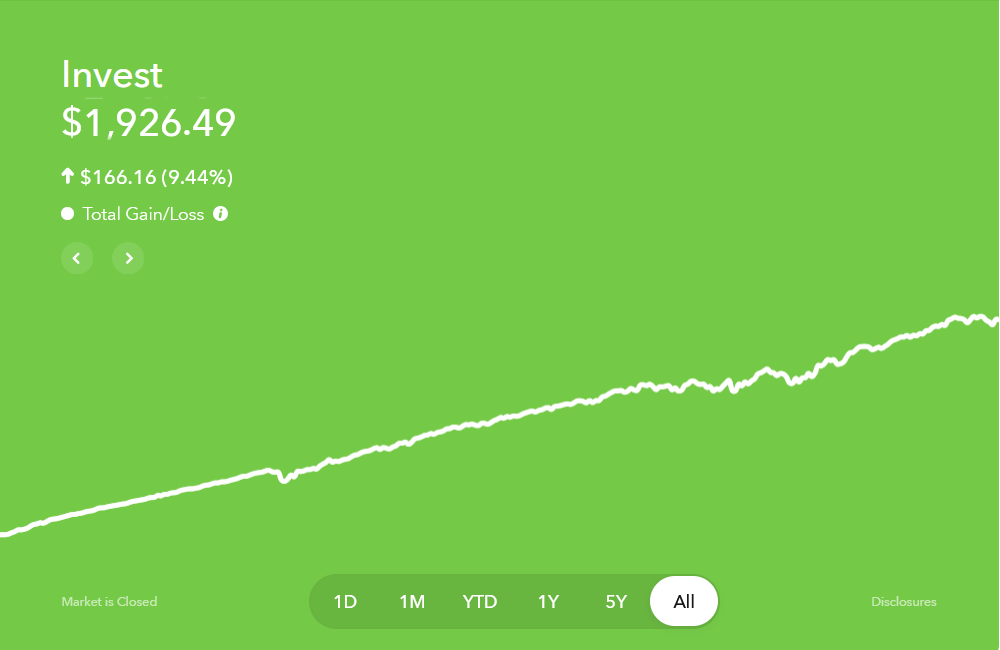

Five years later, this is my Acorns account balance history as of 10/17/23:

My account value is $1,926.49

The total market gain is $166.16

*Note these numbers do not take into account the $3/month fee.

Last year was a brutal year for investment portfolios – so far 2023 has been better.

There are five ETF portfolios to choose from ranging from “Conservative” to “Aggressive”.

I chose “Moderate” which is 60% stocks and 40% bonds.

The portfolios are well diversified across several asset classes. The stock ETFs hold over 11,000 different stocks from across the globe! Acorns rebalances regularly.

Acorns is simple and automatic. Beyond the initial setup and adjustment of the whole dollar round ups, I’ve done absolutely nothing. I rarely look at it, except to write this update every October!

Automaticity is one of the keys to successful saving and investing.

Obviously I’m not going to get wealthy doing this. But I love the idea of automatically saving and investing amounts so small that I don’t even notice. Acorns says the average user invests over $30 a month through round-ups. My average is about $30 monthly.

In addition to “round-ups” there is an option to set up a recurring investment amount (minimum $5) on a daily, weekly, or monthly basis. I have not done this.

I don’t have a plan for this money yet. Maybe I will wait until it reaches a certain dollar amount and cash it in to do something really “splurgy”. This will incur some capital gains tax, assuming I sell in the future at a gain.

For now I’m content to keep rounding up and auto investing.

It’s a glorious age we live in when a mere $5 gets you a diversified stake in the wealth creating power of the global capital markets! This certainly was not the case in the 70’swhen I was counting egg money on the shag carpet at my grandmother’s house.

*I do not have any affiliation with Acorns.