The first Presidential election I can remember was 1972. McGovern vs. Nixon. I was in first grade at Lincoln Elementary School in Aberdeen, South Dakota.

The day before the election, my teacher Mrs. Dutt told us we would all vote the next day. That evening I excitedly told my parents I was going to vote for McGovern, since he was from South Dakota.

They solemnly told me I should vote for Nixon.

But the next day I put the ‘X’ in the purple mimeographed square next to the donkey and George McGovern’s name.

Of course my vote didn’t count, but my parents’ votes did — McGovern lost in a landslide, not even carrying his home state. In the end, it didn’t turn out so well for Nixon either.Once again, it is a presidential election year.

There is a lot of uncertainty, stress, and anxiety in the air. We are in the midst of a heavily politicized health and economic crisis.

Elections matter. But should you let your politics influence how you manage your investment portfolio?

History suggests no.

It is difficult to identify systematic return patterns in election years. On average, market returns have been positive in election years and the subsequent year.

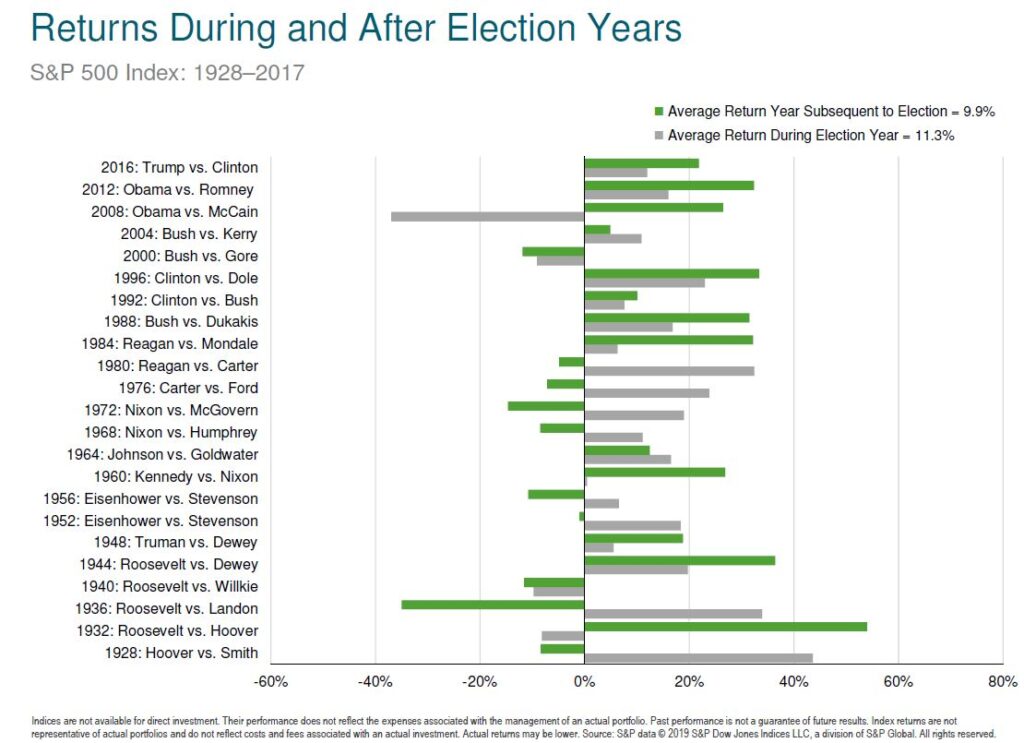

Here are the returns of the S&P 500 (the 500 largest US company stocks) during and after election years from 1928-2017.*

The average return of the index during elections years is 11.3%, the year after an election 9.9%

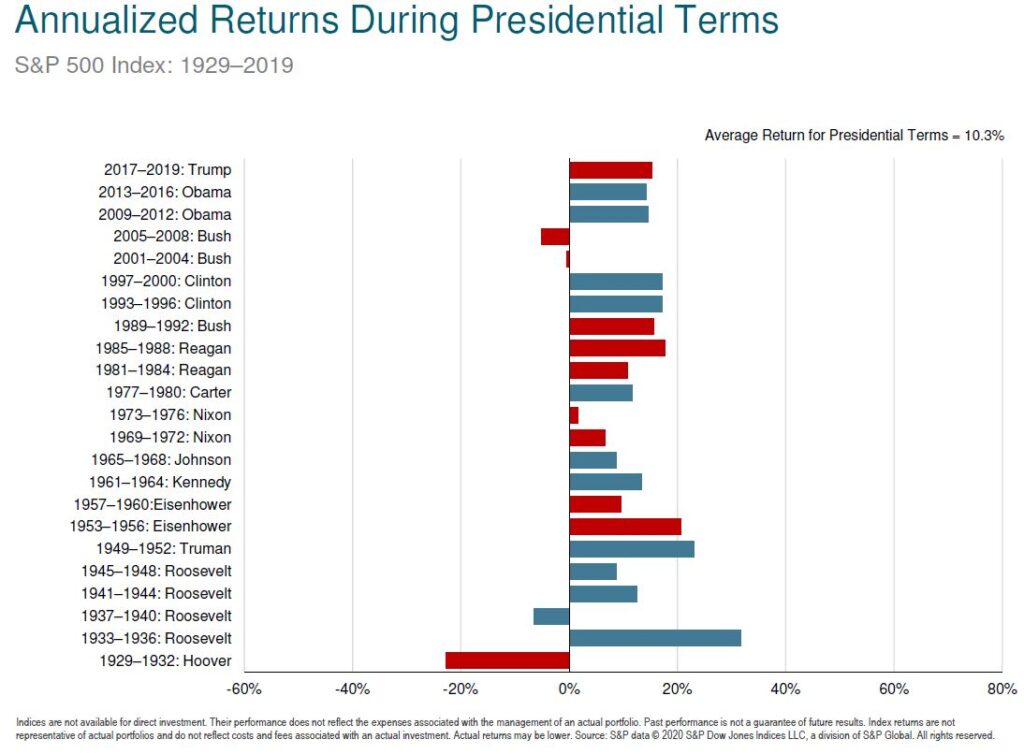

Here are the annualized returns of the same index during presidential terms. Red bars show Republican presidential administrations and blue bars Democratic presidential administrations.

The average return for all presidential terms is 10.3%

Neither party is clearly better or worse for the stock market.

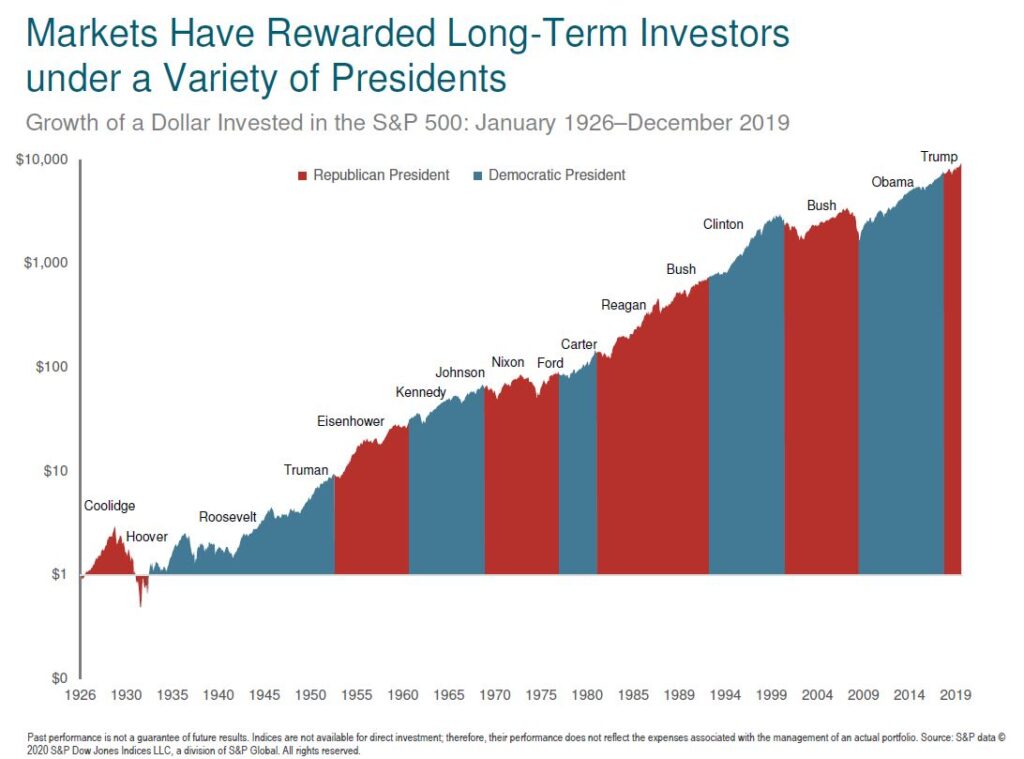

Markets have rewarded long-term investors under a variety of presidents.

It’s understandable to have concerns about the election. By all means, register and vote. Participate in the process in whatever way you choose.

But as far as your portfolio and the markets are concerned, history suggests that elections are non-issues.

Part of successful investing is understanding what you can control. Make a plan, focus on your long-term financial goals, stay the course with a globally-diversified balanced portfolio, and tune out the noise.

*All illustrations are from Dimensional, a mutual fund company I use for a portion of mine and my clients’ portfolios. I receive no compensation from them. You can view the original document here. It shows additional illustrations with similar patterns for international stocks (from both developed and emerging foreign countries) as well as bonds.