Hello!

A lot of people dread the idea of seeing a financial advisor.

But as one of my best friends frequently says: “The truth will set you free”.

And this month I debut a new feature called “What I am Reading”.

Read on to learn more.

Best,

Michelle Morris, CFP®, EA

BRIO Financial Planning

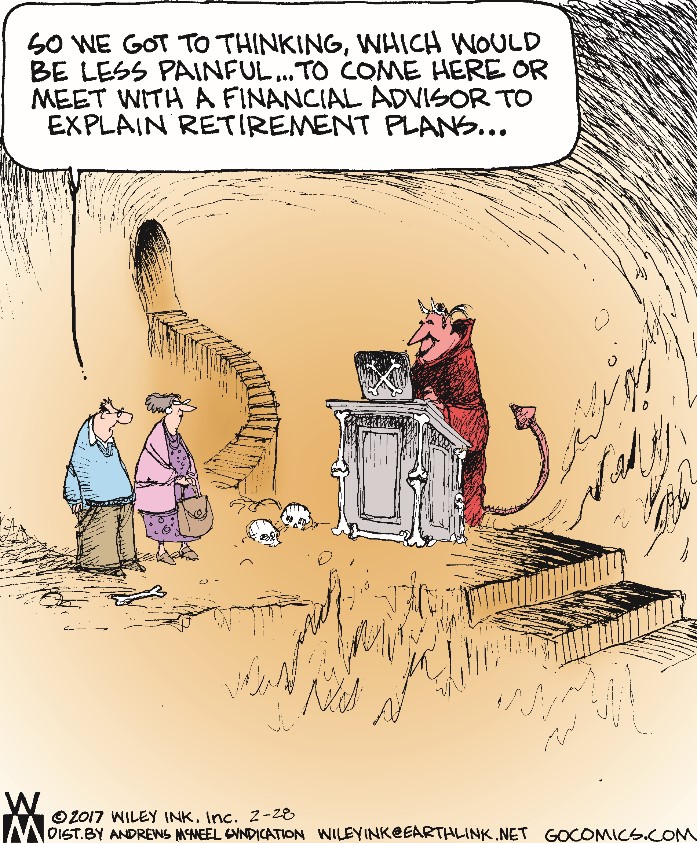

Recently clients sent me the following cartoon:

NON SEQUITUR © 2017 Wiley Ink, Inc.. Dist. By ANDREWS MCMEEL SYNDICATION.

NON SEQUITUR © 2017 Wiley Ink, Inc.. Dist. By ANDREWS MCMEEL SYNDICATION.

Reprinted with permission. All rights reserved.

They did say not to take it personally!

I love this cartoon, even if it does suggest that going to hell would be preferable than coming to see me!

There are a lot of reasons people dread the idea of talking to a professional about their finances.

There is a general taboo in this country about talking about money. We’ve all heard the adage not to discuss money, politics or religion at a dinner party.

Maybe thinking about money stirs up negative emotions dating back to childhood. Perhaps your mother was an extreme miser or your father spent most of his paycheck on booze.

Maybe you are fearful of running out of money and becoming a bag lady. It’s easier to ignore the fear rather than facing it.

Maybe numbers hurt your head.

Maybe you’re busy and think “it will all work out somehow”.

But it’s impossible to avoid life’s twists and turns and nearly all of them involve questions about money.

How has my financial and tax situation changed now that I am married/a parent/divorced/widowed?

What funds should I pick in my new job’s 401k plan?What should I put on my new job’s W-4 form?

What should I do with the old job’s 401k plan?

Will I ever be able to retire?

Should I contribute to an IRA? What kind of IRA? Where should I get an IRA?

Uncle Horace died and left me money, what should I do with it?

What should I do with the dusty stack of savings bonds from Aunt Louise?

Do I need a will? Do I need a trust? Where should I go to get either?

Do I need life insurance? How much? What kind?

What happens if I get sick and can’t work?

Do I have the right mix of investments?

I’m worried the stock market is going to crash, what should I do?

How can I get better return on my portfolio?

How can I lower my tax bill? (Likely your largest bill!)

Should I buy a house? How much house can I afford?

Should I pay off my mortgage? Should I refinance my house?

Should I buy a second home?

Should I buy the annuity my brother-in-law Bob is trying to sell me?

How should I save for college?

When should I start taking Social Security?

The list goes on and on and on. It’s overwhelming. It’s anxiety producing.

But it’s not quite as bad as eternal fire.

As another of my friends says “The way to eat an elephant is one bite at a time”.

Comprehensive financial planning can help you answer all these questions, one at a time, in the context of your big picture. And I’m pretty sure most of us have comfortable climate-controlled offices. ![]()