The Social Security Administration recently started rolling out newly designed statements.

The new statements graphically illustrate the increase in income from delaying benefits.

Here’s the retirement benefit information from an old statement:

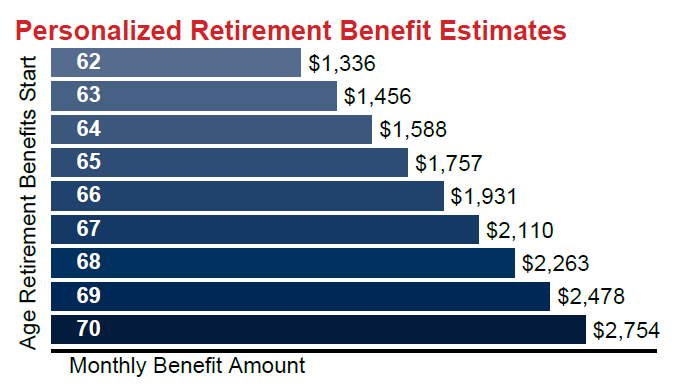

From a different client, the retirement benefit illustration from a new statement:

The new design helps workers get a better understanding of the income increase they can gain from delaying their benefits. It can make sense to delay claiming your benefit even if you have retired. It all depends on the numbers, but if you have other assets to draw on, holding out for a larger Social Security payment could be more beneficial in the long run.

According to the Social Security Administration, these redesigned statements are being targeted at a “small percentage” of online users. They plan to gather feedback and make updates before rolling out the new design for all users.

Another feature of both designs is your earnings history. A client recently told me that looking at her earnings history was a trip down memory lane — she couldn’t believe how much her income had gone up over the years!

Have you looked at your Social Security statement recently? Social Security recommends checking your statement annually to make sure your prior year’s earnings were recorded accurately. Check that your name and date of birth are correct as well.

You can view your statement online. If you don’t have an online account you can set one up at ssa.gov