Hello!

How long will you live? Of course, nobody knows the answer for sure. Like many questions in financial planning, there is no Magic 8-ball with answers.

Read on to learn more about longevity statistics!

Best,

Michelle Morris, CFP®, EA

BRIO Financial Planning

I frequently talk to clients about when to retire, when to take Social Security, and how long they might expect their portfolio to last.

The answers to these questions hinge in part on length of life.

With Social Security, you collect a larger check by waiting.

If you delay until age 70 to receive your maximum benefit instead of starting as early as you can at age 62, your check is at least 57% larger.* If you live past approximately age 80, you come out ahead by waiting.

*Note: I use complex software to advise clients about their specific Social Security options which vary depending on a host of factors. Consulting an expert before collecting is a good idea!

Vanguard has a useful calculator to estimate the probability of living until a certain age.

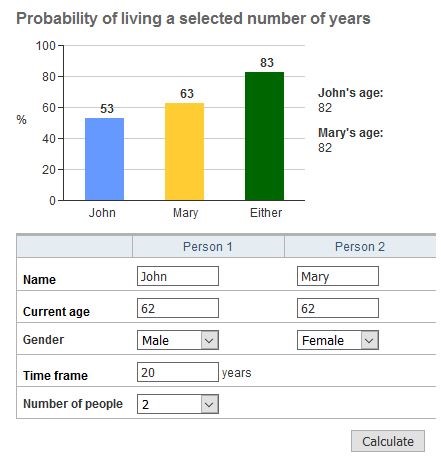

Let’s look at John and Mary. They are both 62. What is the likelihood they will live another 20 years, to age 82? We plug in John and Mary’s age and gender and get the following result:

Mary has a 63% chance of living to age 82. John has a 53% chance of living to age 82. But there is an 83% chance that ONE of them will live to be 82. Pretty good odds!

It may make sense for one or both of them to delay their Social Security benefit.

If only one member of a couple is going to delay, it often makes sense for the higher earner to delay. This maximizes the lower earner’s survivor benefit if the higher earner dies first.

Note there is no rule that says you must start collecting Social Security as soon as you stop working!

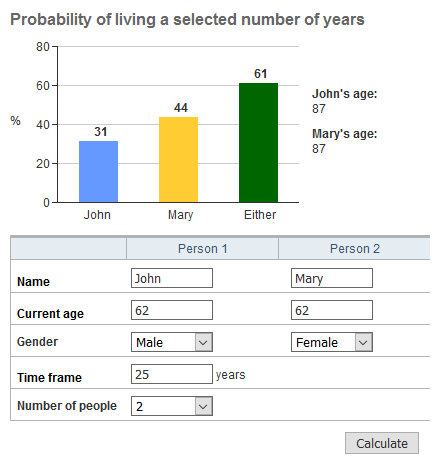

Let’s look at the calculator again. What is the likelihood that John and Mary will live another 25 years?

Mary has a 31% chance of living to age 87. John has a 44% chance of living to age 87. There is a 61% chance that ONE of them will live to be 87.

But if anything, this tool may underestimate life expectancy for my clients. Why? It uses data from the Social Security Administration; their database includes every single person with a Social Security number. In reality, the fortunate people in the top quartile for education and income (the kind of people who seek my services), have a longer life expectancy than average.

If you are interested in fine tuning your individual predicted life expectancy, you can take a detailed quiz here (Really detailed, as in “what kind of snacks do you eat?”) You do have to give an email address to get your result. I’ll be working & saving for a while!