The American Rescue Plan, signed into law March 2021 includes a temporary one year enhancement to the Child Tax Credit for 2021.

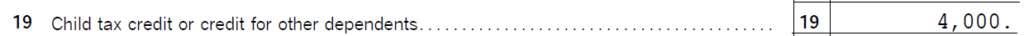

In 2020 the Child Tax Credit was $2000 per eligible child under age 17.

Look on line 19 of your 2020 Form 1040 to see if you received this credit:

This client has two children, ages 12 and 9:

For 2021 the Child Tax Credit is increased to:

- $3,000 for children ages 6 to 17

- previously 17 year olds were not eligible, this year they are

- $3,600 for children age 5 and under

- These amounts are based on the child’s age on 12/31/21

Also new for 2021 — 50% of the credit will be paid in advance in 6 monthly installments from July 2021-December 2021.

The exact timing of these monthly payments is not yet known. Similar to the stimulus payments the IRS will likely use your direct deposit information if they have it.

Depending on your income, you may not receive the full amount.

The “enhanced” amount above $2,000 is phased out for incomes above:

- $150K for joint filers

- $112.5K for Head of Household Filers

- $75K for all others

Confusing? Of course it is, it’s the tax code!

Let’s look at two examples using Kiplinger’s Child Tax Credit Calculator:

To use the calculator you need these items from your 2020 tax return (or 2019 if you have not filed for 2020).

- Filing status

- You can find this at the top of page 1 of your 1040 form

- Adjusted Gross Income

- You can find this on Line 11 of your 2020 1040 form

- Or Line 8b in 2019

- You can find this on Line 11 of your 2020 1040 form

- Number of dependent children claimed on your return and their ages

- Dependent children are listed on page 1 of your 1040 form above Line 1.

- If they qualify for the Child Tax Credit the box to the right of their name has a checkmark

Example #1:

John and Jane have 2 children both claimed as dependents. The youngest turns 4 in 2021 and the oldest will be 8.

They file their return jointly and their Adjusted Gross Income in 2020 was $95,000

We plug their data into the calculator and see this:

Your estimated monthly payments from July to December 2021 will be:

$550.00

Your estimated credit amount claim on your 2021 tax return (to be filed in 2022) will be:

$3,300.00

Let’s break it down:

John and Jane qualify for an expanded Child Tax Credit in 2021 of $6,600

- $3000 for the 8 year old and $3600 for the 4 year old.

- 50% of the credit ($3300) will be paid in six monthly installments of $550 July-December

- The remaining 50% ($3300) will be claimed on their 2021 tax returned filed in 2022.

Example #2:

Mary and Mark also have 2 children, both claimed as dependents. They are twins who turn 10 in 2021.

They file their return jointly and their Adjusted Gross Income in 2020 was $160,000

We plug their data into the calculator and see this:

Your estimated monthly payments from July to December 2021 will be:

$458.00

Your estimated credit amount claim on your 2021 tax return (to be filed in 2022) will be:

$2,750.00

Let’s break it down:

Mary and Mark qualify for the expanded child tax credit in 2021, however they do not get the full amount because their Adjusted Gross Income is above $150,000*

- $2750 for each child (reduced from $3000 for each child).

- 50% of the credit ($2748) will be paid in six monthly installments of $458 July-December

- The remaining 50% ($2750) will be claimed on their 2021 tax returned filed in 2022.

*The phase out calculation is a $50 reduction of the total credit for every $1000 over the AGI phase out amount.

More details:

- The phase out only applies to the enhanced portion of the credit which is the extra $1,000 or $1,600 above the base of $2,000.

- The original “base” amount of $2,000 does not phase out until Adjusted Gross Income reaches $400,000 for Married Filing Jointly filers.

- The original “base” amount of $2,000 does not phase out until Adjusted Gross Income reaches $400,000 for Married Filing Jointly filers.

- If your income in 2021 goes up, you may have to give back a portion of your pre-payments when you file your 2021 tax return.

- Your actual credit will be based on your 2021 income, filing status and dependents claimed

- Your actual credit will be based on your 2021 income, filing status and dependents claimed

- If you are divorced and claim your child as a dependent every other year with your ex, then you may have to pay back any prepaid tax credit.

- If you are in this category, I recommend reviewing your situation with your tax advisor

- If you are in this category, I recommend reviewing your situation with your tax advisor

- You can choose to opt out of advance payments

- The IRS plans to open an online portal by July 1st allowing you to opt out of the monthly payments. You might want to opt out if:

- You’re concerned the IRS might overpay you and you don’t want to pay it back next year

- You would prefer a larger lump sum next year

- The IRS plans to open an online portal by July 1st allowing you to opt out of the monthly payments. You might want to opt out if:

- There is the possibility this temporary increase for 2021 will be extended to future years

- Stay tuned!

- Stay tuned!

This article is not intended to be an exhaustive guide – it is best to review your specific situation with a tax professional!