Like many taxpayers, you might get a refund each year when you file your taxes. Last year ≈74% of individual tax returns resulted in refunds.

The average refund was $2,476.

It’s no secret that taxpayers use the tax withholding system as a form of savings.

Too much tax is withheld from your paycheck throughout the year and then refunded back to you after you file your return. It seems like a windfall, but of course it isn’t.

It’s really YOUR money the government has been holding for you.

One argument against getting a refund — you are giving an interest free loan to the government.

However in today’s interest rate environment that’s not much of an argument. On an average refund that’s only ≈$12 of interest at an online bank. Better than a poke in the eye, but hardly compelling.

But there are two other arguments against letting the government babysit your money all year.

#1 Identity Theft

Identity theft is a large and growing problem.

Sophisticated cyber crooks attempt to scam billions from the IRS every year. IRS vigilance thwarts many of these attempts, but in a lot of cases the fakers get away with it.

Here’s how it works: the scammer files a fraudulent return using your social security number and claims a large refund. Then you file your legitimate return and it’s immediately rejected because a return has already been filed with your Social Security number.

Of course you are the rightful recipient of your refund but getting this sorted out with the IRS, a behemoth bureaucracy not known for stellar customer service*, can takeup to 18 months or more!

You could be in a real bind if you’re counting on that money for a large purchase.

#2 Work Stoppages

According to a government report the pandemic effected the ability of the IRS “to provide timely customer service and tax return processing.”

This understates the case. I’ve heard anecdotes recently of IRS phone hold times stretching into hours.

In June 2020 when the IRS workforce starting returning to work they faced a backlog of 11 million pieces of unopened mail.

It’s not too hard to imagine other types of work stoppages such as a government shutdown.

It is easy in today’s digital age to save money without sending it on a round trip to the government.

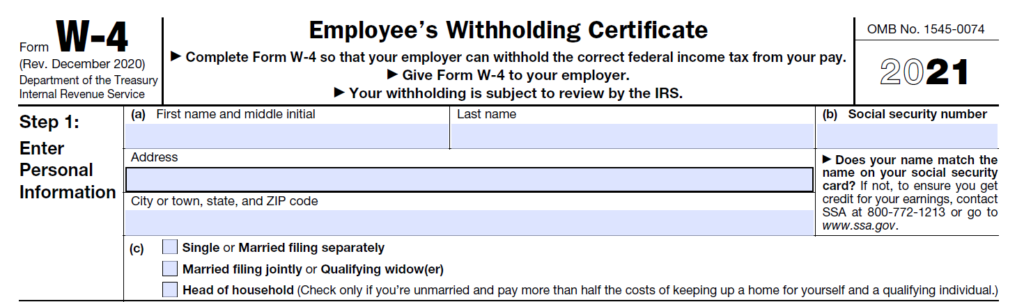

If you get a big tax refund, you can reduce it by lowering the amount of tax withheld from your paycheck. You can get more information about the W4 form online or ask your tax professional to assist you. If you expect any changes to your tax situation you will need to take that into account.

Once you’ve decreased your withholding, set up an automated online savings program. Have the extra money automatically transferredout of your checking account thesame dayyour paycheck gets direct deposited.

Make it automatic — out of sight, out of mind. You can start collecting next year’s refund with your next paycheck.

*To be fair I have spoken to dozens of IRS agents over the years. For the most part they are courteous and try to help. But they work for a complex and convoluted bureaucracy that is underfunded and at the whim of lawmakers. It’s not an easy place to work.