So yes, it’s true that COBRA is expensive…. because your insurance is expensive.

Recently, I was talking with a friend who is planning to leave the workforce and take some time off before looking for a new job.

I asked what she would do for health insurance and mentioned COBRA. Her immediate response was “Oh, no, COBRA is expensive”. *

It is true, COBRA is expensive, because her health insurance is expensive!*

What is COBRA? The acronym comes from the Consolidated Omnibus Budget Reconciliation Act.

COBRA gives employees the right to continue their job’s group health insurance in certain circumstances such as voluntary or involuntary job loss. Generally employers with 20 or more employees must offer this continuation, usually for 18 months.

About 156 million people in the US (roughly half the population) are covered by group health insurance through their current employer. In most cases, the employee pays a portion of the premium (often 10%-20%) via tax-free deductions from their paycheck. The employer pays the rest.

If you go on COBRA, you usually pay the entire cost of the premium. The former employer is allowed to charge 102% of the actual cost.

So instead of paying 10-20% via paycheck deduction that you probably don’t notice, your cost jumps dramatically to the actual cost of insurance + 2% surcharge, paid out-of-pocket.

So, how much money are we talking about? What is the cost of your group health insurance coverage?

Well, there’s an easy way to find out. For most employees, it’s reported on your W-2 form.

Take a look at your W-2 form, Box 12, Code DD: This is the total cost of coverage for your group health plan, both employee + employer contributions.

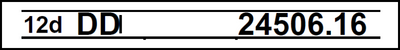

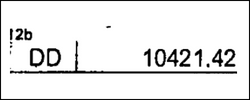

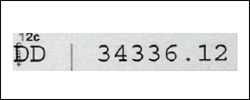

Let’s take a look at a few Code DD’s I’ve seen this year

24K+ for family coverage:

10K for single coverage:

Lastly, the highest one I’ve seen so far this year:

34K+ for family coverage:

Note: This W-2 reporting is for informational purposes only, the amount is not taxable (yet). According to the IRS, it’s to show employees the value of their health care benefits and to give them “useful and comparable consumer information on the cost of their health care coverage.”

*There certainly may be less expensive options available, such as the MA Health Connector. Depending on your income, you may qualify for a Premium Tax Credit.