Hello!

I recently helped a colleague do a retirement projection for one of his new clients. His client was recently widowed and uncertain about her future.

We plugged numbers into the planning software, we did a tax projection, we discussed the best way to deploy her life insurance proceeds, and we discussed the pros and cons of selling her house. There were many things to consider.

Finally I said, “You know, I think it all comes down to what she spends.” And he looked at me and said, “Doesn’t it always?”

There are a slew of things that matter on the path to financial independence, but spending is without a doubt one of the biggest.

What is YOUR spending number?

Best,

Michelle Morris, CFP, EA

BRIO Financial Planning

What is YOUR spending number?

How much money do I need to retire? As a financial planner I hear this question frequently.

The answer is wildly variable. Among my clients it varies a lot – by a factor of 10! What is the difference between these clients? Spending. Spending is the KEY component in figuring out how much you need to accumulate in order to retire.

How much do you spend in a year? If you are a Quicken nut (like me) you can answer that question with a few clicks of the mouse. But I’ve learned that Quicken nuts are few and far between. I’ve developed a relatively easy method for clients to determine their spending number.

This works best for W-2 employees without other sources of income. You will need the following items:

- Your 2014 Fed and State tax returns

- A recent pay stub

- Your 2014 W-2 form

- Access to your 2014 credit card statements

- Access to your 2014 savings account statement.

First, a primer on where our money goes. This is a money machine. Dollars float into our lives (actually they don’t float, we work very hard for them) and they go into one of three buckets: Spending. Taxes. Savings. That’s it.

Algebra alert: If we take INCOME minus TAXES minus SAVINGS we are left with SPENDING.

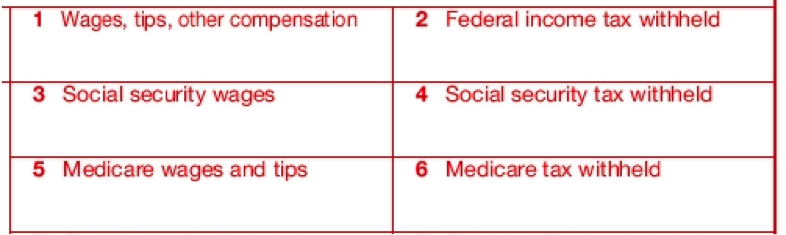

Let’s begin with INCOME: Look on Box 5 of your W-2 form “Medicare Wages and Tips”. ‘

The Box 5 number does not include any pre-tax contributions you make to your employer health insurance plan, check your pay stub to figure out how much that is per pay period, multiply by the number of pay periods per year.

Add these two numbers together- this is your TOTAL INCOME for the year.

Next TAXES: Look on Box 4 of your W-2 form “Social Security tax withheld”, this is your contribution to Social Security.

(In Massachusetts if you are a state/city employee you have a zero in Box 4 because you don’t pay into Social Security, however you do have mandatory pension contributions, you can find that number in Box 14)

Next look on Box 6 of your W-2 form “Medicare tax withheld”, this is your contribution to Medicare.

Next look at line 63 of your 2014 Federal 1040 form, this is your total Federal income tax due for the year.

(As the 2016 Presidential campaign heats up, we will be hearing a LOT about taxes. Now you know how much Federal income tax you are ACTUALLY paying, most people don’t have a clue!)

Next look at line 35 of your 2014 Massachusetts Form 1, this is your total MA income tax due for the year.

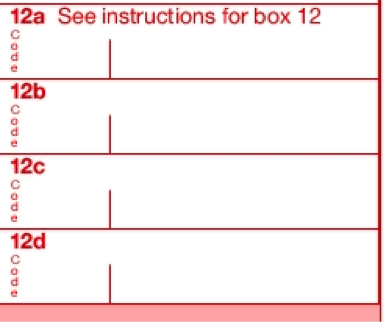

As an aside- do you see a Code DD in Box 12? That’s the total cost of your employer sponsored health insurance coverage. It is a big number!

Did you make any traditional or Roth IRA contributions?

Did you contribute to a 529 plan for your child’s college education?

Did you save any additional money? Check your savings account balance January 1 and compare to December 31. If it went up that is additional savings.

Add those savings numbers together, this is your TOTAL SAVINGS.

Now take the TOTAL INCOME number and subtract the TOTAL TAXES number and subtract the TOTAL SAVINGS number. The result is TOTAL SPENDING.

Last step, if you don’t pay off your credit cards every month, take a look at the credit card balances on January 1 and December 31. If the balance went up you ADD that amount to your total SPENDING number as you are spending money you don’t have. If the balance went down you SUBTRACT that amount from your total SPENDING number as paying down credit card balances is a form of savings.

What’s your spending number? Are you surprised by it? I’ve walked through this process with many clients and the reaction I get ranges from “Yeah, that sounds about right” to the client hyperventilating and falling off the chair.

If you don’t have any idea what you spend, I recommend you walk through this exercise, with your spouse, if you have one.

If you don’t believe the result you come up with then the next step is to start tracking spending. The best method to track spending is the method you will use. I like Quicken, others find Excel or paper and pencil is fine. Online applications include mint.com or youneedabudget.com. Any of these methods do require effort. But like any new habit, it gets easier with time.

Knowing how much you spend is a crucial step in calculating how much you need to retire. It is true that some expenses may go down in retirement, and others may go up. The first step is to establish your base spending number.