Tax reform is here and 2018 brings many changes to the tax code.

One of the major changes is a near doubling of the standard deduction.

What is a standard deduction?

Every taxpayer gets to deduct from income a certain amount of money which lowers their tax bill.

Taxpayers can subtract a flat “standard” deduction, OR “itemized” deductions.

Examples of itemized deductions in 2017 include medical expenses (subject to a 7.5% of income threshold), state income taxes, real estate taxes, auto excise taxes, mortgage interest, charitable contributions and certain miscellaneous deductions (subject to a 2% of income threshold).

Taxpayers subtract whichever is LARGER, a standard deduction or the total of their itemized deductions.

In general homeowners are more likely to itemize since mortgage interest and real estate taxes are itemized deductions.

The basic format of subtracting from income the larger of the standard or itemized deductions has not changed for 2018. What HAS changed is that the standard deduction is much higher.

In 2017 the standard deduction for a single taxpayer was $6,350. In 2018 it is $12,000.

For married taxpayers filing jointly, the standard deduction in 2017 was $12,700. In 2018 it is $24,000.

The standard deduction is even larger for taxpayers over age 65.

One big change is a cap on the itemized deduction for taxes paid. The total deduction for state income taxes, real estate taxes, and auto excise tax is capped at $10,000. This will hurt those in states with high income taxes and high real estate taxes.

Another change for 2018 is an elimination of the miscellaneous deductions subject to 2% of income such as union dues, tax prep fees, investment advisory fees, and job expenses. These are no longer allowed.

You may have itemized deductions for many years, but going forward fewer taxpayers will be itemizing. Currently about 30% of taxpayers itemize deductions. In 2018 only ≈10% of taxpayers will itemize.

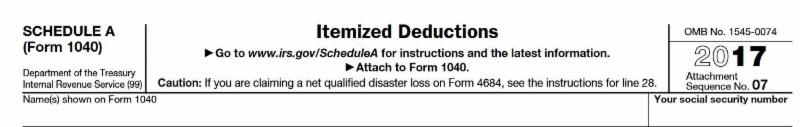

Schedule A for Itemized Deductions might not be a part of your future.

In 2017 this couple had $20,331 of itemized deductions which exceeded their standard deduction of $13,950. So they itemized.

In 2018 if everything stayed the same, they will have $18,218 of itemized deductions. They lose the portion above 10K for their taxes and no longer have the miscellaneous deductions. Their standard is $25,300 which is larger so they will NOT itemize in 2018. They will take their new larger standard deduction.

Now let’s take a look at a single taxpayer:

|

Take a look at your Schedule A if you itemized in 2017. What do your numbers look like?