Tax season is over and I am grateful my office coffee maker waited until April 20th to stop working. I enjoy coffee year round, but especially during tax season.

You may find this strange, but I actually enjoy looking at tax forms so while it’s fresh in my mind I’d like to review one of the most common ones, the W-2.

If you are employed, you receive a W-2 each year from your employer.

The IRS and, if applicable, your state taxing authority also receive the form.

Some taxpayers briefly contemplate their W-2 to prepare their own taxes.

For those who outsource their tax prep, it gets thrown onto the pile of forms to give their preparer. Many don’t even take it out of the envelope! My letter opener gets a workout every year during tax season.

Like many tax documents there is a huge amount of information on this form.

So go grab your W-2 form and we’ll dive in. (Go ahead and find it, I’ll wait….)

To illustrate, I am using snippets of an actual client W-2 form. We’ll call her Mary.

The W-2 form has a series of boxes numbered 1 – 20.

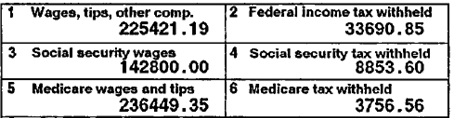

Starting with Box 5 – Medicare wages and tips: This number includes your total gross wages, both regular and any bonus.

If you have any employer stock compensation such as Restricted Stock Units that vested during the year, the value is also included in Box 5.

Later we’ll see premiums paid by your employer for group life insurance may also be included in Box 5.

Not included in Box 5 are your paycheck deductions for employer health insurance or contributions to a Medical or Dependent Care Flexible Spending Accounts. Paycheck deductions toward a Health Savings Account are also excluded from Box 5.

Box 6 – Medicare tax withheld: Medicare tax is 1.45% of Box 5. For Box 5 wages over $200K, an additional 0.9% is withheld from the amount over $200K.

For Mary:

$200,000 * 1.45% = $2,900

$36,449.35 * (1.45% + 0.9%) = $856.56

$2900 + $856.56 = the Box 6 amount of $3756.56

Whether you actually owe extra Medicare tax and the amount is calculated on Form 8959 of your tax return.

Next, we’ll hop up to Box 1 – Wages, tips, other comp.: This is Box 5 MINUS any pre-tax contributions to an employer retirement plan such as a 401k.

This number, along with Box 1 amounts from any additional W-2 forms for you and your spouse if filing jointly, flows to line 1 of the 1040.

Box 2 – Federal income tax withheld: This is the amount of Federal tax you had withheld from your pay.

Your employer sent this in throughout the year as a pre-payment of your total tax bill. You can change the amount of tax you have withheld by turning in a W-4 form.

This number, along with Box 2 amounts from any additional W-2 forms for you and your spouse if filing jointly, flows to Line 25a of your 1040 form.

Box 3 – Social security wages: This is the amount of your wages subject to Social Security tax.

It is the same as Box 5 but is capped at $142,800 as we see here for Mary. The cap goes up each year, for 2022 it is $147,000.

Box 3 is the amount that is used to calculate your future Social Security Benefit.

Box 4 – Social security tax withheld: This is 6.2% of Box 3

$142,800 * 6.2% = $8853.60

Note: if you see zeroes in Boxes 3 and 4, you did not pay into Social Security at this job, most likely because you are a public employee. You may still qualify for a Social Security benefit if you ever had other jobs where you did pay Social Security tax.

If you receive a pension based on this public employee service then your Social Security benefit will likely be reduced – but not eliminated – by the Windfall Elimination Provision.

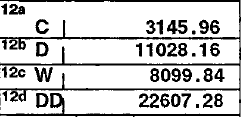

Next we’ll take a look at Box 12:

There are over 30 different codes that can appear in Box 12. Mary has 4 of the most common codes.

Code C: This is the premium paid by your employer for group life insurance in excess of $50,000. This amount is taxable to you and is included in taxable wages. The premiums go up with age, Mary is 60. Two years ago her box C code was ≈$2000.

Code D: Pre-tax contributions to your 401(k) plan. Box 5 MINUS Code D = Box 1.

For Mary: $236,449.35 MINUS $11,028.16 = $225,421.19

Code W: Employee paycheck deductions and employer contributions to a Health Savings Account.

Code DD: The total cost of employer-sponsored health coverage, for a family in this case. It’s an eye-popping number. This is not subject to tax. If you have ever wondered how much COBRA coverage would cost if you left your job, it is essentially this number + a 2% administration fee. There may be less costly options.

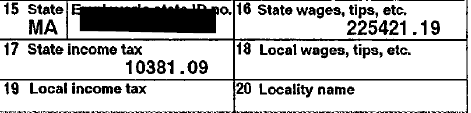

Next we’ll go to the bottom of the form Boxes 15-20.

Box 16 – State wages, tips, etc.: In most cases this is the same as Box 1 and goes on your State income tax return. In MA, if you are a state or municipal employee this number is typically higher than Box 1.

In MA this number, along with Box 16 amounts from any additional W-2 forms for you and your spouse if filing jointly, flows to Line 3 of your MA Form 1.

Box 17: State income tax: As with Federal tax your employer sent this in throughout the year as a pre-payment of your total tax bill.

In MA this number, along with Box 16 amounts from any additional W-2 forms for you and your spouse if filing jointly, flows to Line 38 of your MA Form 1.

If you live in a state with no income tax these Boxes 16 and 17 will be blank.

There are no Local income taxes in MA so Boxes 18-20 are blank. If you live or work someplace that does have these taxes (such as NYC) you will see numbers here.

This ends my tour of the W-2 form — I hope you enjoyed it!