Year end is a great time to review your 401k contributions — or 403b/457 plan contributions if you don’t work for a private company.

I like these plans for a lot of reasons.

Most plans these days have some decent investment options. Some have both pre-tax and Roth contribution options.

Your employer may match a portion of your contribution.

Many plans allow you to set up an ‘auto-increase’ on an annual basis. You set your contribution to increase by a certain amount (usually a percentage of salary) each year. One of my clients set up auto-increase to coincide with her annual raise. After several years she hit the maximum!

But best of all, the money is deducted from your paycheck and invested before you even see it.

The same thing again next paycheck and the one after that and the one after that and the one after that…..

Save, invest, repeat. Save, invest, repeat. The simple, but not always easy, formula for accumulating wealth.

In 2023 the maximum contribution amounts for these plans is going up.

Starting in 2023 you can contribute a maximum of $22,500. If you are 50 or older, you can contribute an additional $7,500 for a total of $30,000!

Perhaps you are looking at these numbers thinking “Michelle, don’t be ridiculous, I could not possibly put that kind of money in my 401k!”

That’s fine! Start with something and build on it over years. Even modest contributions add up over time.

Does your employer match your contributions? Try, at a minimum, to contribute at least enough to get the full match. Otherwise you’re leaving money on the table.

Let’s go back in time and take a look at a mythical person named Mary. It’s 1992, and she gets paid 2 times a month, or 24 times a year.

She decides to invest $100/paycheck into her company 401k plan. Just $2400/year.

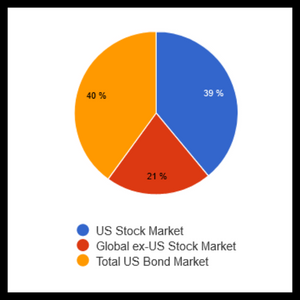

She picks a 60% stock / 40% bond portfolio that looks like this:

She puts in a little more each year based on inflation.

The dividends are reinvested.

The portfolio is rebalanced once a year.

She starts on January 1, 1992.

The first year she puts in $100/paycheck.

Every year her contribution goes up a little bit.

By year 10 she is putting in $128/paycheck.

30 years later (believe me, this goes by in a flash!) she is putting in $194/paycheck and her balance is $300,832.

I love these charts called ‘mountain charts’. Of her $300,832 only $110,295 was contributed by her.

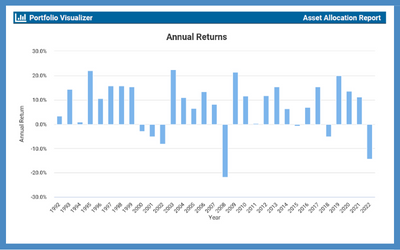

The chart below shows that Mary had down years. But there were many more up years.

Check your 401k contribution – if you are maxing out you can add more in 2023 thanks to increased limits.

If you’re not maxing out, add just a little bit. If your plan allows auto-increases set them up.

If you’re not contributing at all, get started with even a tiny amount.

And then save, invest, repeat. Save, invest, repeat and don’t interrupt the compounding!