In recent months several of my clients have happily experienced an increase in cash flow.

The reasons include:

- Paying off a student loan

- Paying off a mortgage

- Decreased daycare costs due to a child starting school

- Stopping monthly allowance to an adult child who graduated and got a job (yay!)

In each of these cases cash flow went up because of a decrease in a regular expense. Cash flow can also go up from an increase in income such as a raise or a bonus.

Clients who have been with me a while know my standard response to an increase in cash flow: “Capture those dollars!”

What do I mean by that?

If you do not intentionally capture increased cash flow dollars, they end up in what I call “the vortex of spending”

Once in the vortex you look back later asking “what did we do with that extra money?” Answer: We spent it on “stuff”.

However if you consciously capture these newly excess dollars you can divert them to something more tangible.

My first choice for new dollars is always SAVE IT!

Savings options include:

- Retirement – increase your 401k plan contribution and save on taxes too!

- Emergency fund – set aside some dollars for a rainy day if you haven’t already

- Education – 529 plans can be a great way to save for your children/grandchildren’s education

The important thing with all savings is to AUTOMATE it. Make the dollars disappear before they get sucked into the vortex of spending!

- You can have 401k contributions automatically deducted from each paycheck.

- You can have 529 plan contributions auto-deducted each pay day.

- You can have emergency fund account transfers on automatic each pay day.

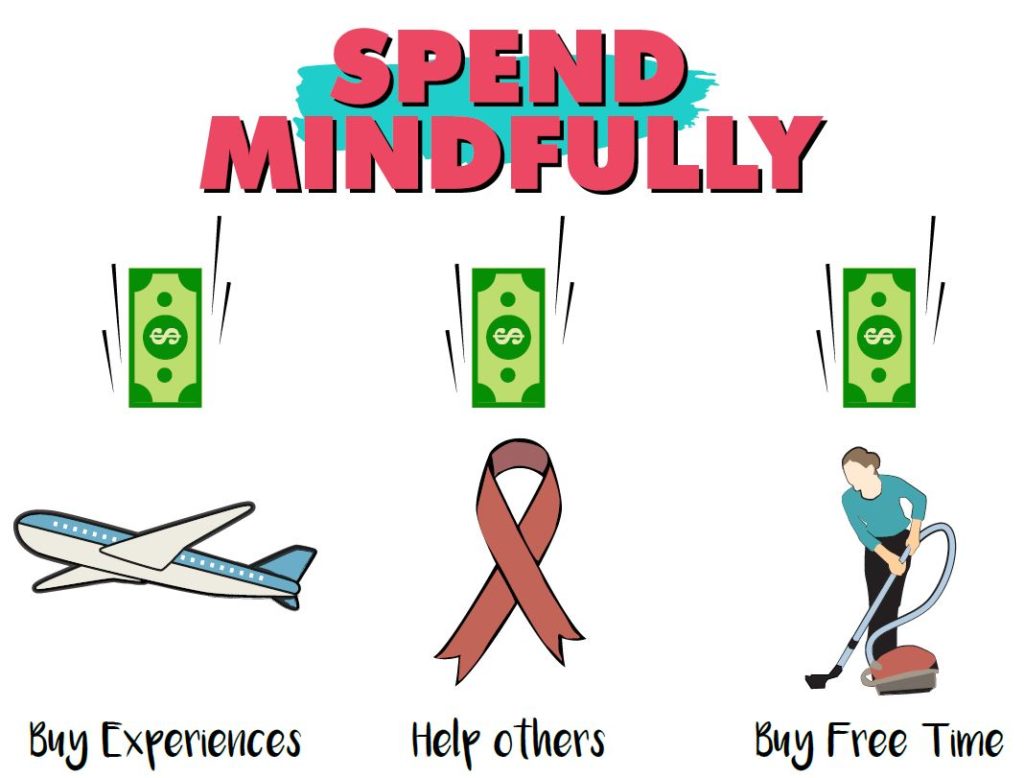

Mindfully spending newly found dollars is also an option.

Can spending money make us happy? Researchers tell us it can – if you spend mindfully.

Examples of mindful spending include:

- Buying experiences not things

- Helping others

- Buying free time for ourselves

The next time your cash flow increases – capture those dollars!