Hello!

My father was a real “Buy American” guy. I came of age in the 70’s and early 80’s in the rural Midwest. Ethnic food did not arrive in my hometown until 1982 in the form of a Mexican fast food joint called “Aunt Chilottas”. My father worked at an automotive parts store. The rare intrepid soul who walked in asking about parts for a Japanese car was promptly dismissed as foolish and often the subject of scorn at our dinner table.

The world has changed a lot since then. Notably there are Japanese cars everywhere and many Americans partake of international food, products, culture and travel. These add richness and diversity to our lives. So it is for international stocks also.

My Dad has passed away and while I doubt that he would have ever bought a foreign car, I’m pretty sure I could have talked him into some international stocks and maybe even some Mexican takeout!

Best,

Michelle Morris, CFP®, EA

BRIO Financial Planning

When I review prospects’ portfolios I often see minimal or even no allocation to international stocks. But if you limit yourself to only US stocks you are missing a big piece of the global capital marketplace.

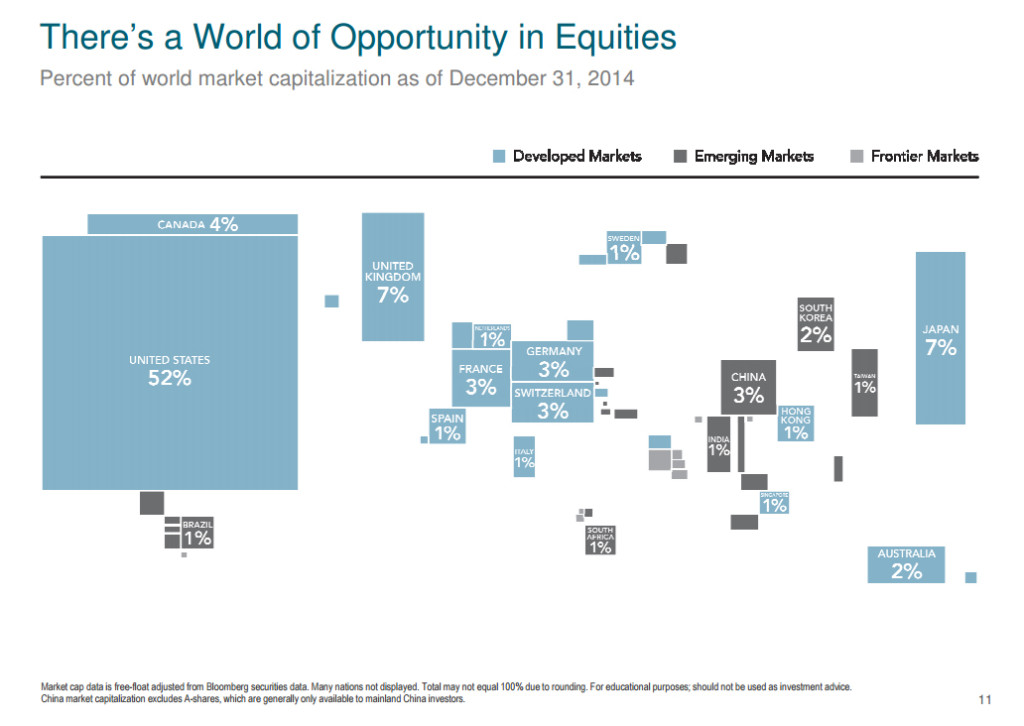

This cartogram, from Dimensional Fund Advisors, shows the global market share for stocks of countries all over the world. The US is the biggest at 52%. This means that of the total value of the world stock market, the US accounts for 52%.

In other words, the US accounts for just over ½ of the total value of the world stock market. By limiting yourself to US stocks you’ve lost exposure to 48% of the global stock market!

(Click image to enlarge)

We’ve been hearing a lot about Greece lately. You’ll note it’s not even listed on this chart-its total is less than 1%. In fact Apple stock alone is more than 20 times bigger than the entire Greek stock market. Certainly the issues in Greece may cause some short term volatility, but the world has faced innumerable financial crises in the past and will undoubtedly continue to do so in the future. Don’t let the news dissuade you from sticking with a broadly diversified long-term investment strategy.

Some think buying US stocks provides exposure to international economies due to the large international presence that many US companies maintain. This is true to some extent, but limiting yourself to US companies means you have no stake in leading companies based in other countries such as Toyota, Samsung, or Nestle.

Certainly US stocks have had a great run recently. The US had the highest annual return of the 19 developed market countries tracked by MSCI in both 2013 and 2014. But as recently as 2012 the US was 14th on this same list. In 2004 the US was dead last. What will the winning country be in 2015? 2016 and beyond? I have no idea, but guarantee you that I and my clients own it in our diverse portfolios.

Remember, don’t look for the needle in the haystack, just buy the haystack!

One easy way to “buy the haystack” is through an index mutual fund: a basket of stocks that holds every stock listed on a particular index. One of the international stock funds I use from Vanguard (VFWAX) has 2,490 stocks. (Hence the title of this article).

The expense ratio of this fund is a mere .14%. This means that for every $10,000 you hold in the fund, you pay just $14 to the mutual fund. Never before have ordinary people had such inexpensive access to huge swaths of the global capital marketplace. It is a marvelous age we live in.

So take a look at your portfolio, are you missing out on a world of opportunity?